Kingsmen is one of the most underrated dividend plays on the SGX with its current share price implying a “heads I win, tails I don’t lose much” scenario.

Kingsmen is a design and production specialist with a track record in paying healthy dividends since its 2003 IPO on the Singapore stock exchange. Kingsmen is a deep value investment with its 4% dividend yield and a strong balance sheet with net cash making up ~50% of its market cap.

Kingsmen was established in 1976 and has built up a huge portfolio of repeat clients such that no client makes up more than 10% of the company’s revenue.

The company has four business segments:

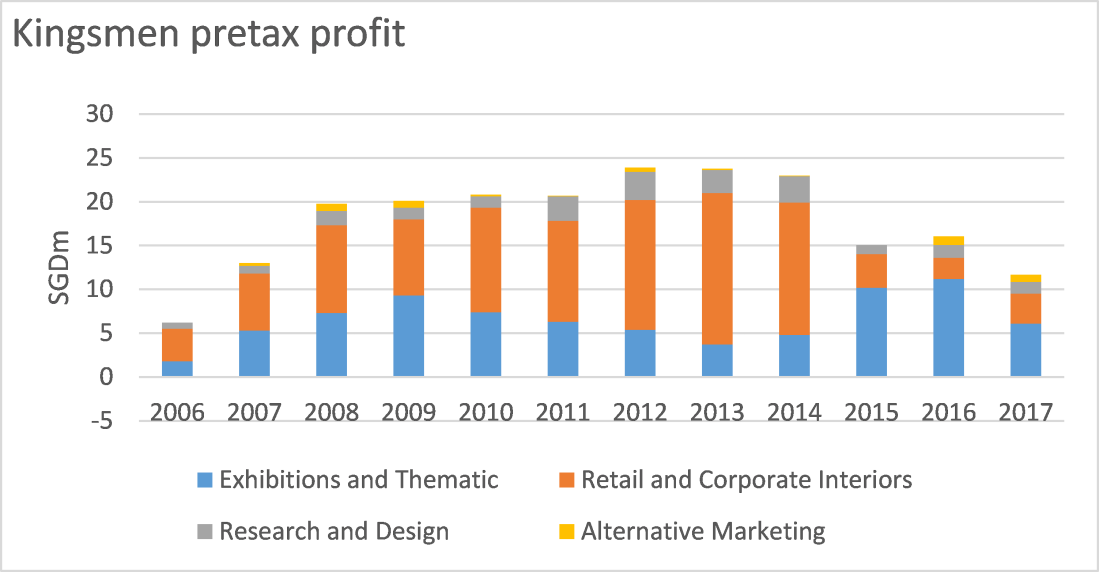

- Exhibitions and Thematic (ET) segment produces exhibition displays for trade shows; museums and theme parks. Clients include Universal Studios, Formula 1 and Singapore Air Show. ET contributed 46% of the company’s revenue and 52% of pretax profit in 2017.

- Retail and Corporate Interiors (Retail) provide interior fitting-out services. Repeat clients include high-end retail brands such as Tiffany, Dior, Fendi and Coach along with department stores such as Robinsons . This segment contributed 46% of total revenue and 29% of pretax profit in 2017.

- Research and Design provides design for retail stores and trade shows.

- Alternative Marketing provides event management and brand consultancy.

I will focus only on the ET and Retail segments since these two segments make up more than 80% of pretax profits.

Why did the share price fall 40% in 3 years?

| Kingsmen results (SGD millions) | |||||

| Year | Revenue | Net profit | Operating cash flow | Free cash flow | Net profit margin |

| 2011 | 261 | 16 | 13 | 10.0 | 6% |

| 2012 | 290 | 17 | 30 | 28.0 | 6% |

| 2013 | 296 | 18 | 23 | 18.0 | 6% |

| 2014 | 336 | 17 | 25 | 22.0 | 5% |

| 2015 | 328 | 19 | 13 | (12.0) | 6% |

| 2016 | 330 | 12 | 15 | 12.0 | 4% |

| 2017 | 307 | 10 | 14 | 2.0 | 3% |

Kingsmen typically generates high quality earnings with the company generating strong operating cash flow while the company currently has more cash than debt. However, revenue and net profit has declined over 2016 and 2017.

Kingsmen aims for 5% net profit margins and has achieved this target for many years. However, the retail market has been facing headwinds from e-commerce. Furthermore, the rise of digital advertising has squeezed interior design budgets for retail stores, forcing Kingsmen to chase lower margin retail and corporate interior work in 2016-17.

Management also decided to stay with key retail clients and accept lower profit to maintain market share. As a result, net profit fell by almost 50% from 2015-17.

Falling revenue and net profit has caused the share price to fall by ~40% from 2015 levels but I think this steady dividend payer is worth a second look for several reasons.

Upside from NERF ignored

In 2018, Kingsmen said it entered into a licensing deal with Hasbro to create and operate NERF family entertainment centers (FEC) attractions across Asia.

From Kingsmen:

Kingsmen Xperience, Inc., its US-based subsidiary has entered into a licensing agreement with global play and entertainment company Hasbro International, Inc. (“Hasbro”) to create, build and operate NERF family entertainment center (“FEC”) attractions across Asia Pacific. A leader in action based performance toys with unparalleled performance, power and popularity, the NERF brand appeals to fans of all ages.

Kingsmen will co-conceptualise, create, build and operate multiple NERF FEC locations with the first location to open by 2019 in Singapore. Each stand-alone indoor entertainment facility will feature multiple activity zones, merchandising and food & beverage areas.

Apart from the press release, few details have been disclosed about the NERF FEC business so investors have mostly ignored the impact of this new initiative. There are also questions if Kingsmen can successfully leverage its design and construction capabilities into operations. However, I think Kingsmen’s NERF business will be a success for several reasons.

Firstly, Hasbro is a huge toy company and Hasbro’s willingness to work with Kingsmen, a much smaller company, speaks well about Kingsmen’s track record in developing retail stores and attractions. Hasbro’s 2017 annual sales was USD5.2 billion, 22x of Kingsmen’s sales. NERF is the largest brand within Hasbro’s toy portfolio.

Secondly, NERF has a 45-year history and has been driving sales growth at Hasbro even without the help of movie releases. Take a look at these quotes from recent Hasbro annual reports.

2017: “NERF is our largest brand and in 2017 posted its fifth consecutive year of double digit revenue growth. It became the #1 toy and game property in the U.S”.

2016 :“Growth in NERF, PLAY-DOH, and MAGIC was offset by declines in LITTLEST PET SHOP, MY LITTLE PONY, MONOPOLY and TRANSFORMERS”

“We’ve doubled our NERF sales amongst females in the last four years”.

2015: “NERF was our largest brand across the Company, posting 13% revenue growth for the year(22%absent foreign exchange).”

NERF is clearly the most important brand within Hasbro and it is enjoying consistent growth. The widespread appeal of NERF toys and its strategic importance to Hasbro suggests that Hasbro and Kingsmen will devote significant resources to ensuring the success of these NERF attractions.

Lastly, NERF has its own fan club “NERF Nation” which includes kids and young adults so this fan base helps add to its recurring revenue. There are also regular NERF events in Singapore so this concept is not entirely new in the country.

NERF valuation

Kingsmen paid Hasbro SGD1.3 million in 2017 for a 13 year license to exclusively develop NERF attractions across Asia. The first FEC in Singapore will be the largest because it will be a showcase project for Kingsmen’s capabilities.

With the company’s small balance sheet, the second and subsequent attractions will involve Kingsmen taking on an asset-light approach by taking part in only development and operation works.

A comparison with Straco has been used to gauge the value of the NERF business since Kingsmen has disclosed limited details on target returns. Straco operates the Singapore Flyer observation wheel and aquariums so the company’s results should reflect the entertainment attractions business.

| Share price | P/E (TTM) | EV/EBITDA | 2017 ROA | 2017 ROE | Net debt/equity | |

| Straco | 0.78 | 14.1 | 6.2 | 13% | 19% | Net cash |

| Kingsmen | 0.58 | 11.9 | 4.6 | 4% | 8% | Net cash |

Straco is earning a 13% return on assets compared to Kingsmen’s 4%. This implies that developing and operating attractions can be a very profitable business. Entertainment attractions also generate recurring sales and cash flow which has led to the market according Straco with a higher P/E ratio.

| Kingsmen NERF segment | ||||||

| ROA | Asset (SGDm) | 2021 Net Profit | P/E | 2021 equity value | 2018 upside per share | |

| Bear case | 10% | 20 | 2 | 14 | 28 | 0.10 |

| Base Case | 13% | 20 | 2.6 | 14 | 36.4 | 0.13 |

| Bull Case | 15% | 20 | 3 | 14 | 42 | 0.15 |

Kingsmen has SGD59 million of net cash as of end-2017. The company is conservative and will probably not invest more than SGD20 million from 2018-21. Even if we adopt a pessimistic scenario where Kingsmen invests capital in 2 NERF attractions and earns a lower return (10% ROA) as compared to Straco, I’m still looking at a share price upside of SGD0.10 per share (~16% upside). Kingsmen’s share price has been unchanged since the announcement so the market has basically ignored the impact of this announcement.

Jewel 2019 opening could revive Kingsmen’s retail design segment

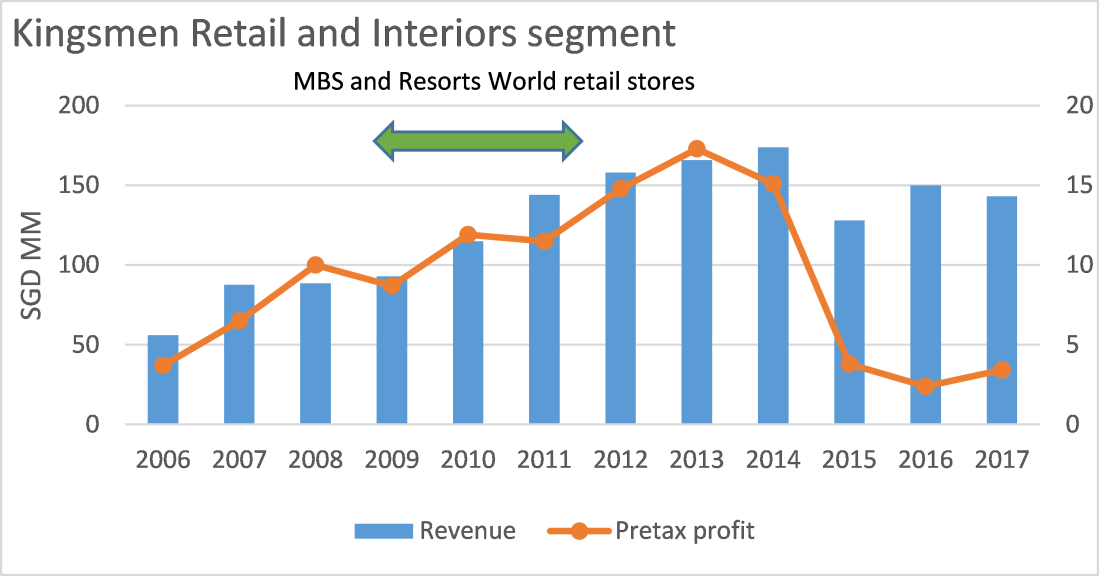

Kingsmen retail business is directly correlated with new retail supply. Kingsmen’s Retail and Corporate Interiors business was able to book ~SGD10 million in pretax profits from 2008-10 when the two Singapore Integrated Resorts – Marina Bay Sands and Resorts World Sentosa were being completed.

The completion of Jewel Changi airport (~300 shops and restaurants) and Funan Centre in 2019 should lead to higher demand for Kingsmen’s retail fit-out services. Funan Centre and Jewel combined works out to the same retail area as Marina Bay Sands Shoppes (800,000 sq feet).

Kingsmen has a long track record in designing and building high-end retail stores within Changi Airport and has delivered several exhibition projects for Changi Airport which includes the recent “Steel in Bloom” displays in Terminal 4.

The new Singapore retail malls over the next 2 years could lead to pretax profit from the Retail and Interiors segment doubling from 2017 levels to SGD7 million and overall EPS increasing by 20% by end-2019.

Exhibitions business provides recurring income

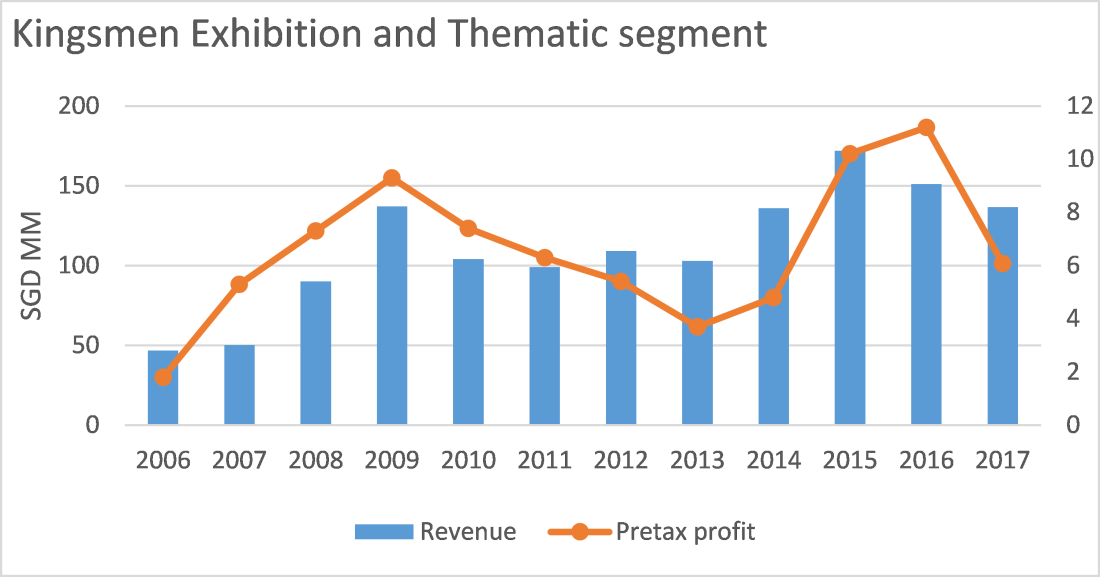

Events and trade shows are a recurring income opportunity for Kingsmen with the company receiving repeat business from major events such as the Singapore Tourism Board, Singapore Air Show, National Day Parade and F1. Singapore is a major MICE destination and was one of the top 6 destinations for meetings in 2016 according to the International Congress and Convention Association. None of its clients make up more than 10% of ET revenue.

ET pretax profit has been strong from 2015-16 but fell 45% in 2017 because of the absence of bi-annual events such as the Singapore Air Show and the completion of several key projects such as Shanghai Disneyland attractions in 2016.The return of bi-annual events such as the Singapore Airshow in 2018 should provide support for 2018 earnings.

Theme parks and museums have to constantly reinvent and upgrade (eg. Hong Kong Disneyland 2016 attendance fell 10% yoy). Given its track record with major theme parks, Kingsmen is well placed to win more work.

Kingsmen has a track record in designing and building attractions for Disneyland and Universal Studios who are expanding their existing theme parks and adding new attractions across Asia. Hong Kong Disneyland and Universal Studios Osaka are introducing new attractions while Universal Studios Beijing is set to open in 2020.

Valuation

Kingsmen is trading at around 1.2x P/NTA and 1x P/B which implies that the market is valuing the business close to its liquidation value and nothing for its existing business or an earnings recovery. The company’s trailing P/E is still relatively high at ~12x because recent earnings performance has been poor but trailing P/E excluding cash is only ~7x.

Here are my valuation assumptions:

- Operating cash flow will remain at depressed levels of SGD14m (5 year average:SGD17m)

- SGD3m of maintenance capex

- SGD11m of free cash flow

- Removed SGD17m of cash to pay for new office building

- New office building will not generate any cash flow or cost savings.

- Assumed no contributions from its new NERF entertainment business with Hasbro.

- 9% WACC

- 2% terminal growth

Using a single stage FCFF growth model, Kingsmen is worth SGD1.04 per share (76% upside). In my view, buying into Kingsmen and its stash of cash at current prices provides a generous margin of safety.

| Growth rate | Cost of capital and Kingsmen value per share | ||||||

| 14% | 13% | 12% | 11% | 10% | 9% | 8% | |

| 0% | 0.63 | 0.66 | 0.7 | 0.74 | 0.79 | 0.86 | 0.94 |

| 1% | 0.66 | 0.7 | 0.74 | 0.79 | 0.86 | 0.94 | 1.04 |

| 2% | 0.7 | 0.74 | 0.79 | 0.86 | 0.94 | 1.04 | 1.18 |

| 3% | 0.74 | 0.79 | 0.86 | 0.94 | 1.04 | 1.18 | 1.37 |

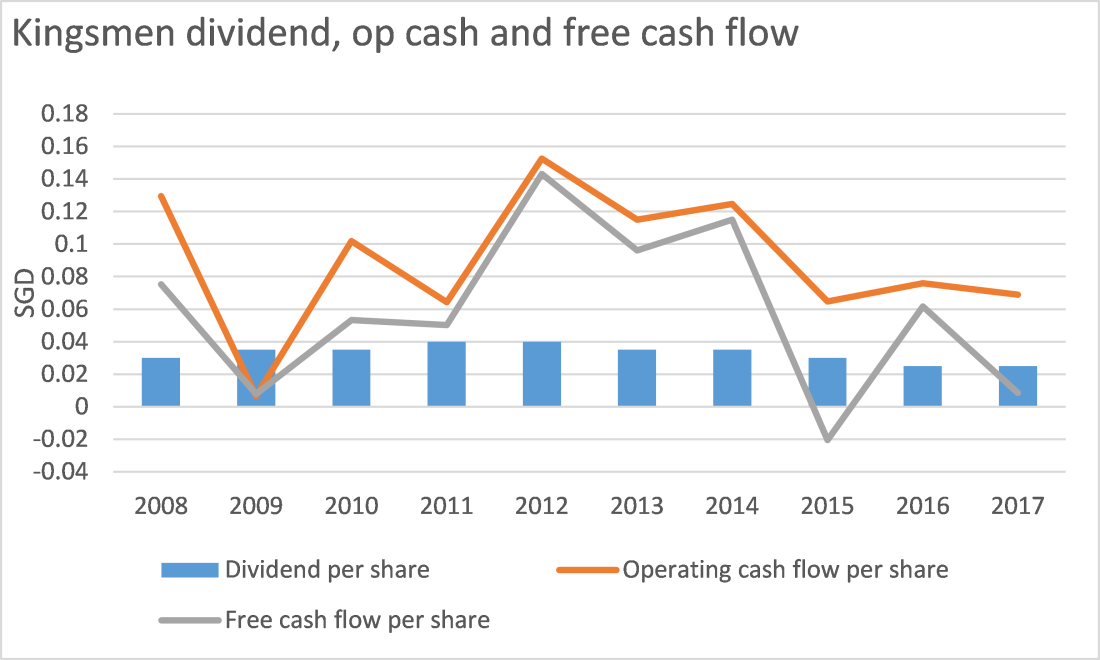

Receive a 4% yield to wait for earnings recovery

Kingsmen has a 15 year track record in paying dividends. In 2015 and 2016, Kingsmen cut its dividend to conserve cash for its new 6-storey Singapore office which will cost a total of SGD35 million. The final SGD17 million payment for the new office is due in 2018 and management has already secured a bank loan.

The current dividend is already at the lowest level in 10 years and should be sustainable as it works out to 50% of its 2017 earnings and is backed by the company’s strong balance sheet and free cash flow.

Free cash flow has been lumpy in recent years because Kingsmen has been spending on its new Singapore office which will cost SGD35m including land costs. But if capex related to the new office is excluded, free cash flow over the last 5 years has averaged at a healthy SGD11 million per year. Furthermore, Kingsmen has SGD59m of net cash which is enough to support its existing dividend (~SGD5 million) for the next 10 years.

Management is aligned with shareholders

As of April 2018, Benedict Soh and Simon Ong, the executive chairman and deputy chairman of Kingsmen collectively own 47% of Kingsmen shares. Benedict Soh and Simon Ong founded Kingsmen together and given their substantial stake in Kingsmen, they clearly have skin in the game. Chairman Benedict Soh spent ~SGD125k buying shares a for the first time since the company’s IPO in Feb 2017. His purchase price amounted to SGD0.625 per share so he clearly thinks Kingsmen is undervalued. Based on their substantial stakes in Kingsmen and recent actions, Kingsmen is probably in good hands.

Key risks

Kingsmen revenue is project-based with the company granting 60-90 days payment terms to its clients so the company is exposed to credit risk. However, this exposure should be manageable as the company has historically generated strong operating cash flows while the credit risk is spread over many clients.

Kingsmen is dependent on exhibitions and thematic attractions for more than 50% of its revenue. A disease outbreak in Singapore could result in the cancellation of events and a sharp drop in revenue.

Conclusion

As a design and production company, Kingsmen is currently facing headwinds from digital advertising and e-commerce. However, a recovery in its retail design business led by a wave of new Singapore malls (Jewel and Funan Centre), a steady 4% dividend yield and recurring income from its ET business could lead to the share price appreciating by 70% over the next 2 years.

Kingsmen will be a royal addition to the Evergreen Investing portfolio. Buying Kingsmen at a SGD0.59 share price has limited downside with cash making up around 50% of its market cap and plenty of free upside from its future NERF attractions and earnings recovery in its core business.