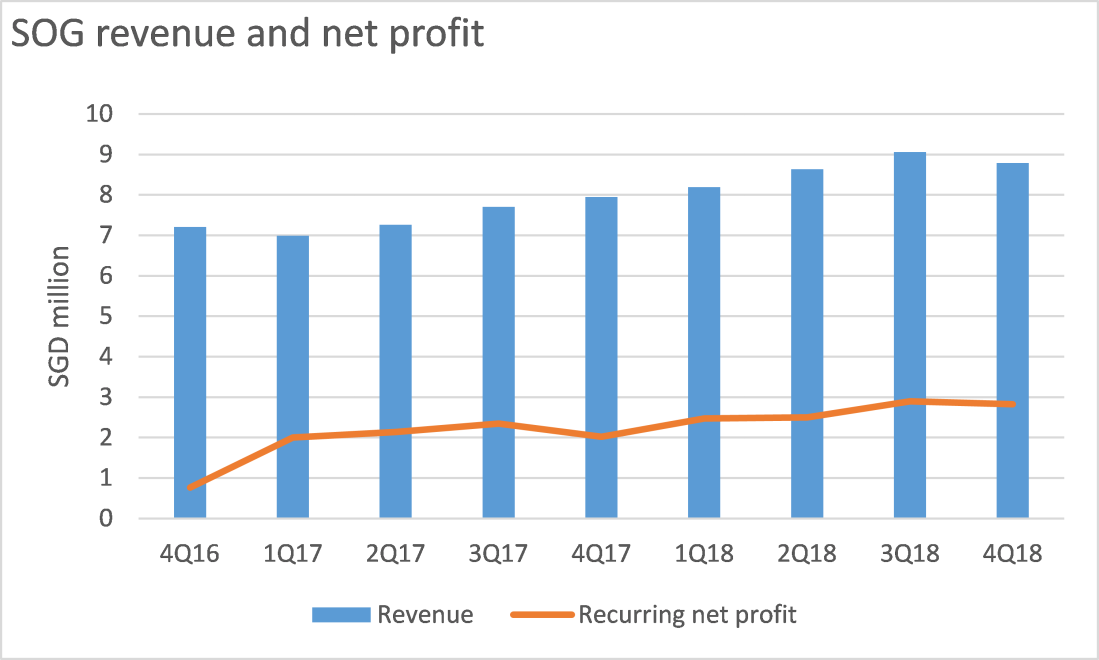

Singapore O&G (SOG), one of my highest conviction holdings reported bad headline results on Friday night. But after digging in, the good news seem to outweigh the bad.

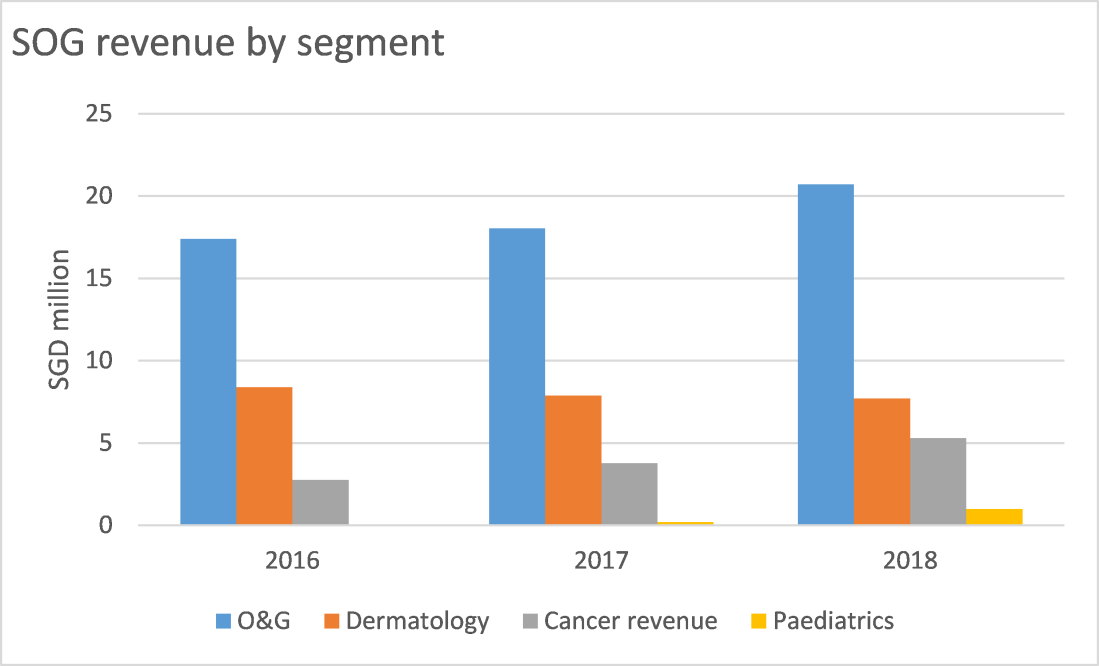

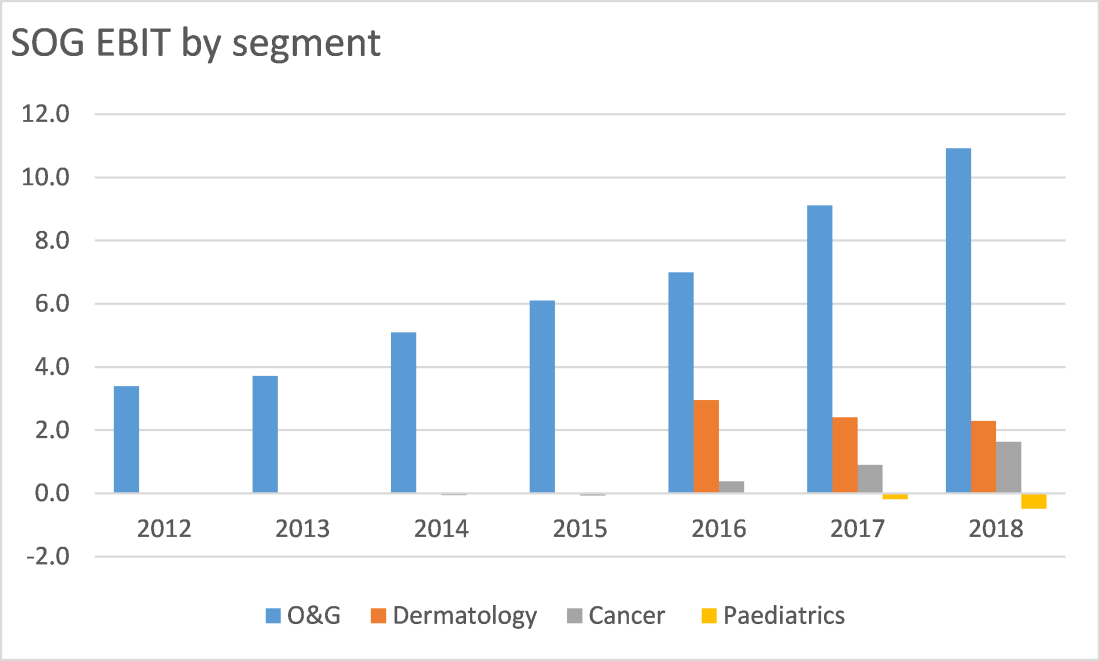

4Q18 revenue grew 10% year on year, recurring net profit was up 39% year on year, operating cash flow was up and the final dividend grew 1%. However, reported net profit fell 98% because of a goodwill charge on the company’s dermatology segment. The dermatology segment has been performing poorly since its 2016 acquisition with revenue and net profit falling every year due to fierce foreign competition. SOG still has SGD24 million of goodwill related to the dermatology acquisition on its books but a complete write-down seems unlikely with the revenue decline slowing in 2018.

I see three reasons to be positive about this set of results.

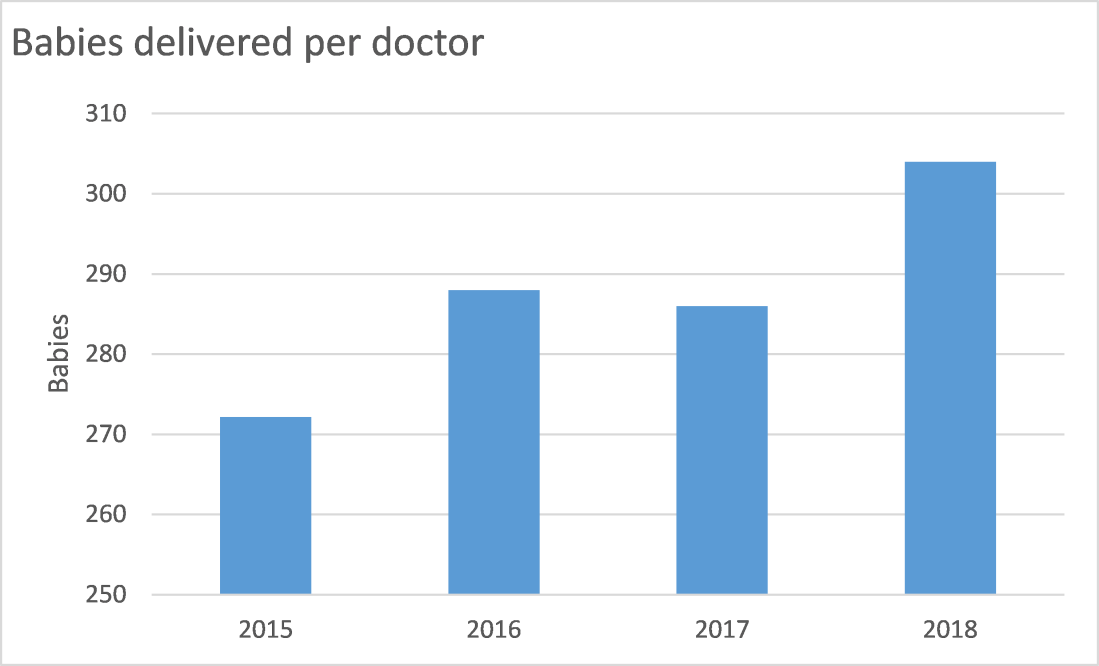

Firstly, SOG delivered a record 1,824 babies in 2018. More importantly, babies delivered per doctor hit a new record as well which suggests that the younger O&G doctors are gaining more recognition with the company becoming less dependent on the three founding doctors.

Secondly, the company’s cancer segment is performing really well with EBIT margins (31%) for the cancer segment exceeding the dermatology segment. This is a really impressive achievement because growth in this segment was driven by the recruitment and ramp-up of younger doctors and not driven by expensive acquisitions.

Lastly, the company is steadily growing its doctor base with the company having 14 doctors in end-2018 compared to 12 doctors in 2017 and 7 in end-2015. A new paediatrian and dermatologist was hired in December 2018. I’m positive because they seem to complement the group’s business really well. The paediatrian (Dr Christina Ong) is a paediatric gastroenterologist, a new and relevant specialty for the company. The new dermatologist (Dr Liew Hui Min) is focused on children and women’s dermatology. Dr Liew’s practice will be co-located in Dr Lee’s O&G Gleneagles clinic so there could be some referral synergies.

I have no idea how the market will react to the goodwill impairment on Monday but hang in there! The company is still dependent on its founding doctors in the next 5 years but if all goes well, I think SOG has a good chance of becoming the next Thomson Medical or Raffles Medical in 10 years.